New investment option launched

On 29 September 2021, we launched a new investment option called Life Cycle. It works slightly differently to the other four investment options currently on offer which each have a distinct risk/return profile. These options rely on you to review your investment choice from time to time and change it if you need to. In most cases, we would expect to see members shifting their savings to a more conservative mix of investments as they get closer to retirement (lower risk/ lower return).

FireSuper’s new Life Cycle investment option is a ‘set and forget’ option that does this for you. The Life Cycle option will automatically adjust (downwards) the allocation to growth assets as members get closer to retirement age. The mix of growth and income assets change automatically as you get older.

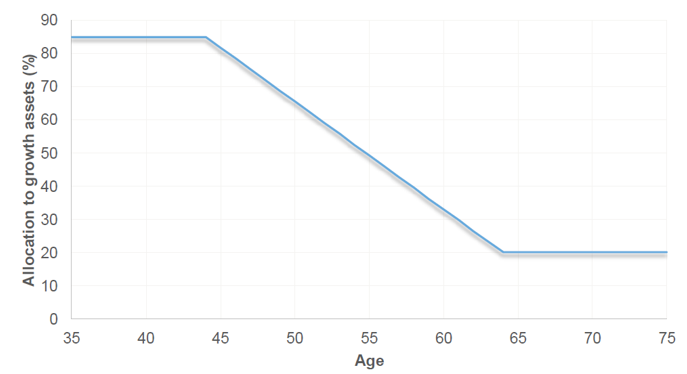

Up until age 45, members’ savings are invested in 85% growth assets and 15% income assets. From then, the percentage of growth assets will reduce gradually to 20% at age 64. The Life Cycle option uses three investment options – Growth, Balanced and Conservative to transition your savings from predominantly growth assets to predominantly income assets over time.

You can read the Product Disclosure Statement for details of the transitions, and an example of how the growth assets reduce based on age is shown in the chart below.

The investment allocation changes will take effect from 1 February each year, and not your birthday or the anniversary of the date you joined the Scheme.

If you choose to join Life Cycle then unlike the other investment options where you can choose a percentage to invest and mix and match options, you must be 100% invested in this Life Cycle option.

Life Cycle is now available to all members. If you would like to join this investment option please log into www.firesuper.org.nz and click "Your Investments". Your first switch in the Scheme’s financial year is free. A fee is charged for any subsequent switch as set out in Section 5, 'What are the fees?' in the Product Disclosure Statement.

Got questions? You can read the Life Cycle Fact Sheet here, or give Helpline a call on 0800 MY SUPER (0800 69 78737).

29 Sep 2021